Planning for Uncertainty

Have you ever received an unexpected phone call from a family member and heard them say, “Don’t worry, everything is okay, but I need to talk to you?”

What’s the first thought that goes through your mind? “Oh no! Something’s wrong!”

This is a funny quirk about our emotions. We can hear one thing that makes us think the exact opposite of what we just heard. “Don’t worry!” can be the phrase that causes us to worry the most.

This is the reason why I haven’t joined most of my peers in sending out an email blast to all of my clients about the current state of the stock market. If I tell them not to worry about the markets, they’ll think to themselves, “Scott wouldn’t have reached out if there was nothing to worry about.”

I believe you can’t make a solid plan with your investments until you have a solid “plan” for your life. Only after you’ve created a life “plan” can you design an investment portfolio to support the plan.

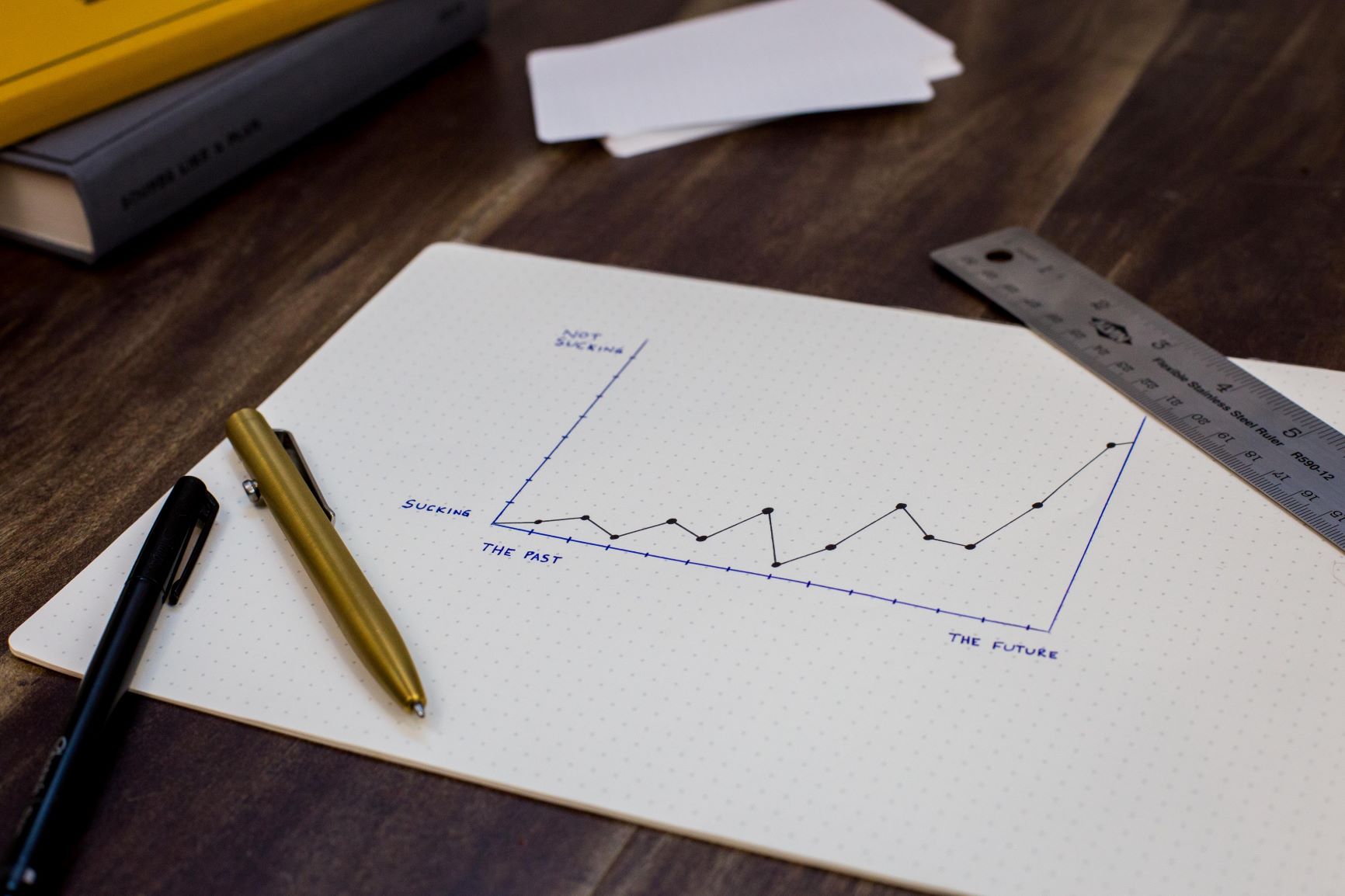

I use the phrase “life plan” loosely because we all know life doesn’t always follow our plans. When you create a life plan, you actually have no idea what the future holds. You can anticipate a guess as to what may happen and what you’d like to happen, but there’s no way to know.

So you make a plan or guess as to what the future will hold for you. Your goals, dreams, retirement plans, anticipated expenses with aging parents or college tuition for kids all might be part of your anticipated plans. And you pick your investments while looking through that lense.

But building a portfolio can be tricky. While we have a lot of information about what the market has done in the past over long periods of time, we have no idea what the market is going to do the next day, or the next year, or the next decade. So in a way, we are making an anticipated guess here as well.

As financial advisors, we do not talk about this a lot with clients because it doesn’t instill confidence. We don’t often tell you that no one really knows what the market is going to do tomorrow. Our culture likes certainty, and we can’t be certain about the future. But the best financial advisors are always thinking about this, and they build uncertainty into your financial plan. We actually build in the fact that we know the long-term trends of the market, but we are just guessing at the short-term results. There are some fancy names for this, like Monte Carlo analysis and sequence of returns risk, but really they are guesses.

What I am ultimately trying to say is that if you have a solid financial plan, it is considering your life plans and already accounting for the fact that we don’t know what will happen tomorrow in the market.

If the next recession starts this month will it mess up your plan? It shouldn’t. We know recessions will happen during your life, and so it is already built into your financial plan.

The key is that you have to stick to the financial plan. You can’t sell every investment and get out of the market when things are scary because that actually will mess up your plan. The plan counts on you being invested in great markets and bad markets.

You can certainly be scared though. If you get scared when the market is scary, that just makes you human! Don’t be ashamed of that. Find a trusted advisor that you can talk to, and stay the course.

If you look at the financial news and feel like you’re riding a roller coaster, or if you get scared when the market drops, I’d love to be someone you can talk with about it. Most of my job is listening to people and helping them make wise decisions for their specific situation.

Hang in there! Ride through the scary markets and give yourself some grace for being scared. Don’t let the next market recession mess up your plan. We know it’s coming at some point, and we have already planned for that.

PS: A quick note that I’m a huge fan of Carl Richards. Thank you, Carl for always giving me a good perspective on the emotions around money, including a lot of the thoughts in today’s post.